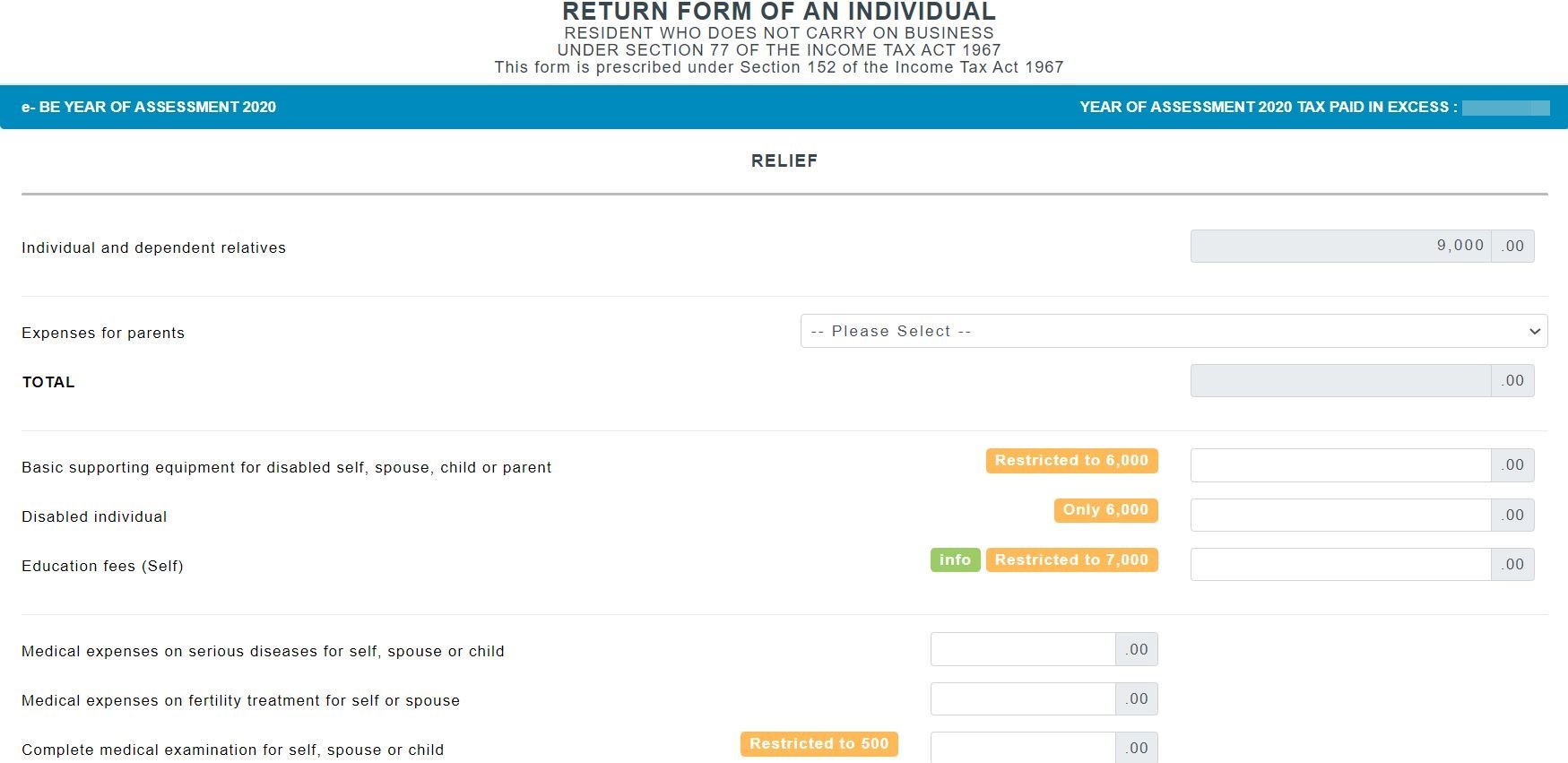

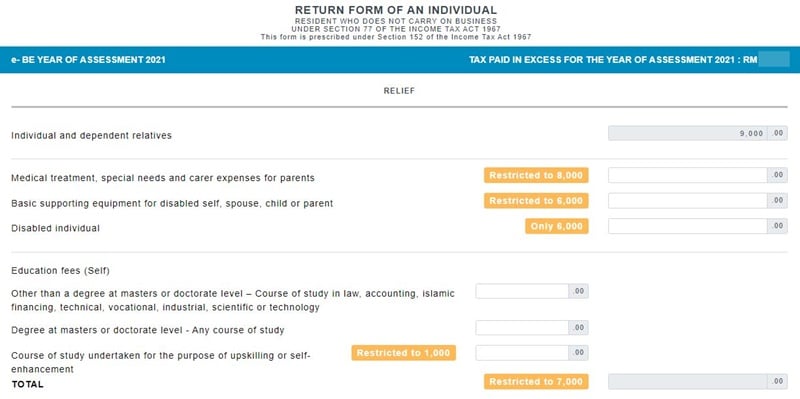

The tax rebate on medical treatment special needs and parental care has been increased from RM5000 in 2021 to RM8000 in 2022. 12021 prior to the extended grace.

Ks Chia Associates 𝗙𝗔𝗤𝘀 𝗼𝗻 𝘁𝗮𝘅 𝗺𝗮𝘁𝘁𝗲𝗿𝘀 𝗱𝘂𝗿𝗶𝗻𝗴 𝘁𝗵𝗲 𝗠𝗼𝘃𝗲𝗺𝗲𝗻𝘁 𝗖𝗼𝗻𝘁𝗿𝗼𝗹 𝗢𝗿𝗱𝗲𝗿 𝗠𝗖𝗢 𝟯 𝟬 The Malaysian Inland Revenue Board Issued The Faqs On Tax Matters During The Movement Control Order

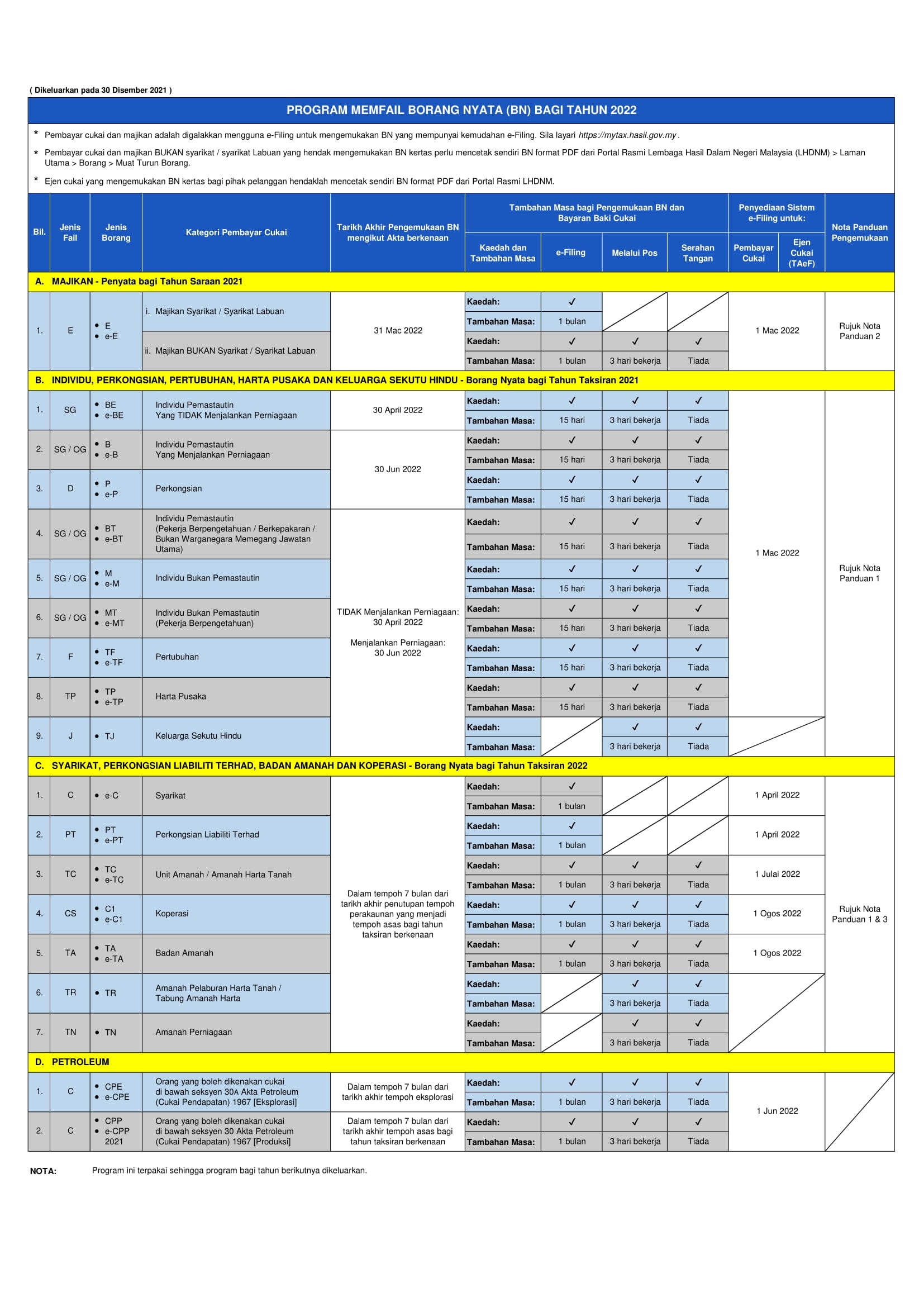

The deadline for BE is April 30.

. For further information consult the dedicated page on the official website of the Inland Revenue Board of Malaysia. The Inland Revenue Board IRB has recently made available on its website the 2021 income tax return filing programme 2021 filing programme titled Return Form RF Filing Programme For The Year 2021. The LHDN could choose to have you prosecuted if you fail to furnish your tax returns.

Employment income e-BE on or before 15 th May. Extended grace period for filing. Personal income tax filing Form BE deadline.

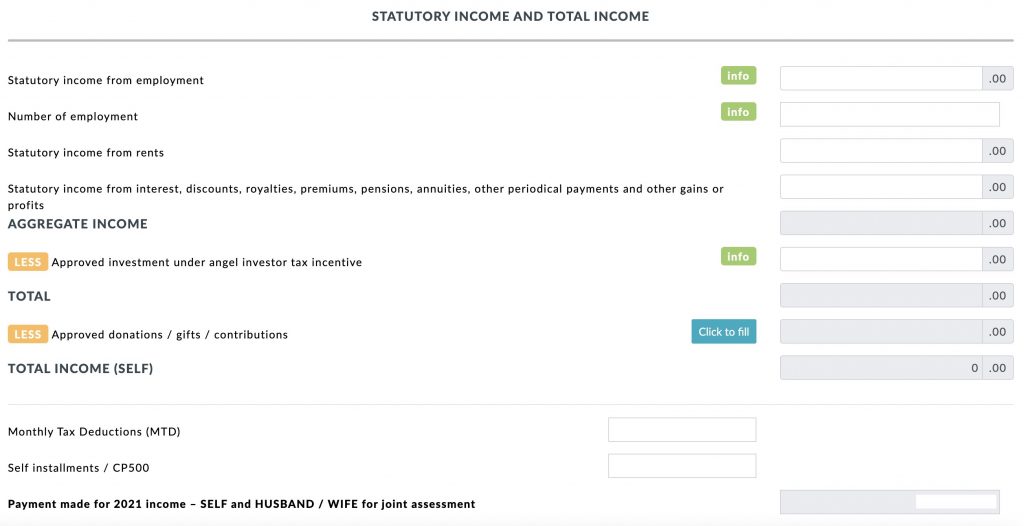

SOLE PROPRIETOR Form B PARTNERSHIP Form P 30 June 2022. The 2022 filing programme is broadly similar in concept to the position laid out in the original 2022 filing programme see Tax Alert No. On the other way round according to the Income Tax Act 1967 only income derived from Malaysia is subject to income tax in Malaysia while income earned outside Malaysia is not subject to tax.

Malaysia has implementing territorial tax system. Individuals resident non-resident individuals including knowledge expert workers partnerships associations. Income tax return for partnerships Form P.

The deadline for e-filing your income tax form is on 15 May 2022 but before that make sure you claim these tax reliefs and possibly get back some money. Form P refers to income tax return for partnerships. Income tax season is upon us.

Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. Business income B Form on or before 30 th June. As for those filling in the B form resident individuals who carry on business the deadline is on 30 June manual.

The IRB has published on its website the 2022 income tax return filing programme 2022 filing programme titled Return Form RF Filing Programme For The Year 2022 dated 30 December 2021. Both residents and non-residents are taxed on income accruing in or derived from Malaysia. The 2021 filing programme is broadly similar in concept to the position laid out in the.

Foreign income remitted into Malaysia is exempted from tax. Calendar year accounting period ending. Yearly remuneration statement Form EA Deadline.

You can see the full amended schedule for income tax returns filing on the LHDN website. 2022 tax filing deadlines. Business income e-B on or before 15 th July Date of online submission may subject to change.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. The deadline for submitting BT M MT TP TF. Form E Important Notes.

Form EA Important Notes. In a statement today IRB also advised taxpayers to submit the Tax Return Form and. For example a company that closes its accounts on 30 June of each year is taxed on income earned during the financial year ending on 30 June 2022 for year of assessment 2022.

Tax return filing and payment deadlines extended by two months March 23 2020 In brief Following the Malaysian Governments implementation of the Movement Control Order from March 18 2020 to March 31 2020 to control the spread of COVID-19 the Malaysian Inland Revenue Board MIRB announced on March 17 2020 that tax return filing and balance of tax. The Malaysian Inland Revenue Board on 19 August 2021 announced an additional one-month extension of time to file income tax returns for 2021. Form B Form B deadline.

Employment income BE Form on or before 30 th April. May 15 deadline to submit tax returns via e-Filing Singapore 28 Feb 2022 Seven in 10 Singapore taxpayers not required to file income tax returns in 2022 more to receive direct bills. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

Although a partnership is not subjected to pay tax it still has to file an annual income tax return Form P to show all income earned and business expenses. For further information kindly refer the Return Form RF Program on the. The Inland Revenue Board IRB or Lembaga Hasil Dalam Negeri Malaysia LHDN has announced that e-Filing submissions for Income Tax Returns for the 2021 year of.

Foreigners who stay and work in Malaysia for more than 182 days are subject to tax and they must file and pay their tax to the Inland Revenue Board of Malaysia. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing. Tax Deadline Year 2022.

The income tax rate for resident individuals is reduced from 14 to 13 on taxable income in the range of RM50001 to RM70000 for the Year of Assessment ending 31 December 2021. 2021 income tax return filing programme issued. Individual Tax Relief in Malaysia.

Thursday 14 Apr 2022 814 PM MYT. The deadline for Form B and P is June 30. In a statement today IRB also advised taxpayers to submit the Tax Return Form and pay their income tax within the stipulated.

The Inland Revenue Board IRB says that the deadline to submit the Tax Return Form for the Year of Assessment 2021 non-business income is on April 30 for manual submissions and May 15 via e-Filing. Extended from 15 July 2021 to 31 Aug 2021 according to LHDN. PERSONAL TAX Form BE 30 April 2022.

According to the Inland Revenue Board Of Malaysia LHDN failing to pay your taxes on time will incur a 10 increment on your payable tax. In this case you may incur a fine of. The deadline for submitting Form E is March 31.

Workers or employers can report their income in 2020 from March 1 2021. Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for resident individuals who carry on a business. The Government has announced an extension of two months for filing income tax from the original deadline in consideration of the Movement Restriction Order MRO that has been enforced during the COVID-19 pandemic.

SDN BHD Form C 7 months after financial year end. The new deadline for filing income tax returns in Malaysia is now 30 June 2020 for resident individuals who do not carry on a. Declaration report of companies Form E deadline.

Income tax return for partnerships. Penalties up to 45 for non compliance to Income Tax Act. If you forget to file them altogether there are two scenarios that could happen.

Individual tax relief up to RM1000. Individual Tax in Malaysia. KUALA LUMPUR April 14 The Inland Revenue Board IRB says that the deadline to submit the Tax Return Form for the Year of Assessment 2021 non-business income is on April 30 for manual submissions and May 15 via e-Filing.

The Malaysian Inland Revenue Department LHDN officially announced the 2021 income tax filing deadline.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax Guide 2022 Ya 2021

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Tax Filing Deadline 2022 Malaysia

Guide To Using Lhdn E Filing To File Your Income Tax

Important Dates For 2022 Tax Returns Leh Leo Radio News

These 22 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Business Insider Business Insi Money Concepts Finance Estate Planning

Due Day Extended For Personal Tax Submission 15 May 2013 E Filing

Malaysia Personal Income Tax Guide 2022 Ya 2021

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

No Extension For Income Tax Filing The Star

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Malaysia Personal Income Tax Guide 2022 Ya 2021

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Green Hills With Forest Under Cloudy Sky During Daytime Photo Free Nature Image On Unsplash Landscape Pictures Landscape Silhouette Landscape Photography